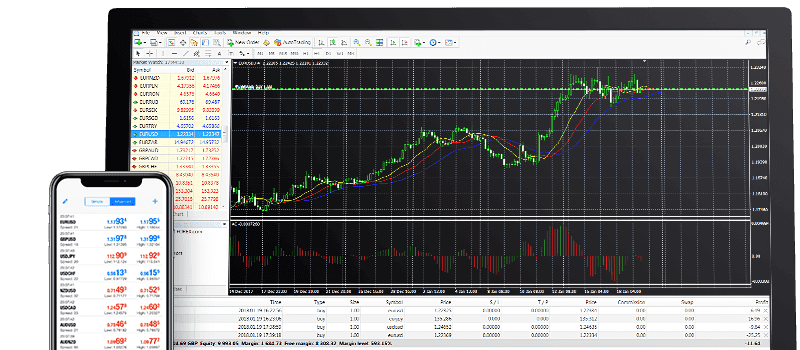

Since Alpari started rendering services in South Africa, local clients have had the opportunity to earn profits by trading currencies on the global market. The software supplied by the broker gives access to trading, and it comes in two versions – MetaTrader 4 and MetaTrader 5. Read on for tips on how to download MT4 trading platform and key aspects every trader ought to know.

Main Benefits of the Platform

MT4 remains the most popular software for Forex trading today. It has a cutting-edge interface, which allows effortless navigation. Upon installation, a trader gains access to such visual aids as:

- Indicators that may be customized;

- Quotes in the Live mode;

- 1-Click-Trading;

- Range of Time Frames;

- Unlimited Charts.

The platform supports not only multiple currencies but also multiple languages, as Alpari MT4 Broker in South Africa is a truly international brand present in many countries. In a nutshell, it gives access to all major tools a trader needs, including the opportunity to trade company stocks and commodities.

Installation on Windows and Mac

Whichever OS you use in South Africa, the setup poses no problems. In both cases, you begin by downloading the necessary file from the provider’s website and running it using the wizard.

With Mac, however, you have to follow the standard procedure for any non-App Store app. This means opening the installation file, followed by dragging and dropping into the app’s directory. The platform is also optimized for portable devices. Hence, you can find versions of it on both the Google Play Store and App Store for the iPhone.

Signing In and Logging Out

Whether the program prompts you to put in your login information or not, this is the first mandatory step upon the initial run. Unless prompted, you may open the ‘File’ tab with the ‘Login to Trade Account’ option. The details you type in could be those of your demo or actual trading account.

Since there is no logout button, you may ensure the software does not save your credentials by adjusting the settings. The ‘Save Account Information’ box must be left unchecked, which causes logout upon closing of the program.

Trading Currency Pairs

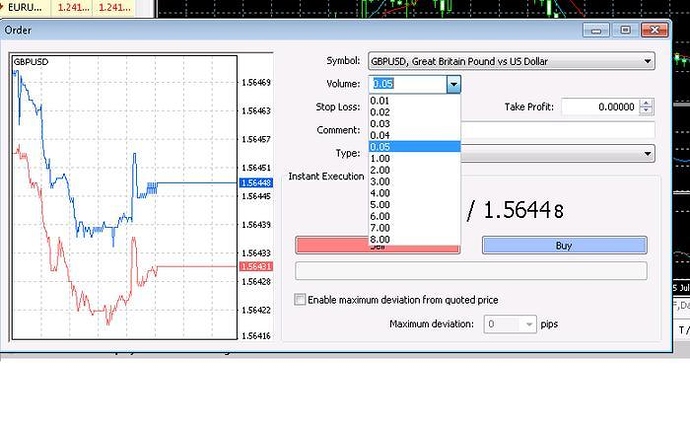

To open any trade, head to the ‘Order’ window, which allows instant order placement. Pick the necessary pair via the top ‘Window’ tab, followed by ‘New Window’ and ‘New Order’ on the toolbar.

The window contains all the information you need: the pair, the volume (in lots), the Stop Loss and Take Profit values, type of trade, as well as graphs displaying recent changes in Bid and Ask prices. Alternatively, you may open an ‘Order’ window using F9.

If you want the trade to be executed immediately, you need to specify the ‘Market Execution’ type. In other cases, you may go for a limit or stop order. This ensures that the execution occurs at a certain pre-set level that differs from the current price on the currency market. If you need a short position, the procedure is simple. Just place a corresponding sell trade to open.

Exiting a Trade

This task is no rocket science, either. Head to the ‘Trade’ tab located in the ‘Terminal’ window (the latter may be summoned with CTRL+T). All the current open trades are shown in the ‘Trade’ part. By right-clicking on any order, you may finalize it via the ‘Close Order’ option. In the case of multiple active trades, this manual approach is best, as it allows you to deal with an individual position. Alternatively, you can use a stop or limit order.

Placing a Limit Order

To open or exit a trade this way, use the ‘Take Profit’ field in the ‘Order” window and specify your desired price level. If you are opening a position, remember to choose ‘Pending Order’ as position type. This will open a drop-down menu with two options: ‘Buy Limit’ and ‘Sell Limit’.

These are some of the most useful features included in the platform package. MT4 offers many other money-making operations. This finance software is indispensable for anyone interested in making a profit on foreign currency exchange.